- Many cryptocurrency holders or investors do not know what to do in a bear market

- Just as there are those who want to quickly get rid of their crypto assets, such as Bitcoin and altcoins, others prefer to wait and, if this is the case for you, you will benefit from the following suggestions.

- A falling market presents endless opportunities that you probably could not stop at in different circumstances, so you should pay attention to those elements that you have at hand

In these troubled times for Bitcoin and altcoins, in which we even think more than once if cryptos have bottomed out, in this case we ask ourselves how to survive a bear market without suffering it . Obviously, there are many investors who will want to know some secrets in these troubled days..

Based on these doubts that may arise in this regard, we believe that it is necessary to be clear about what the steps to follow are, and that means that we will bring you several recommendations, five tips to move in the midst of this convulsive cryptocurrency market , at least until the uncertainty passes.

a bit of context

Bear markets are a daunting time for any cryptocurrency holder or investor. Generally, most tend to think that these instants lead to sustained, even significant, money losses. However, we are aware that there are enough exceptions not to rush ..

And just as it is true that no market can go up forever, bear markets present their own opportunities and can be a great time to correct any past mistakes, or learn.

Therefore, what you need to do is make the most of your time and money throughout the bear market. For informational purposes only, we intend to bring you some useful proposals for these weeks..

Five tips for a bear market

stick to the plan

In this quest to survive a bear market, we are aware that most people will abandon any strategy. Almost everyone will try to get rid of their precepts and get out .

And that is precisely the main reason why we advise staying inside and sticking to the original plan. Those who had the guts to buy into a tough market made huge returns in the long run.

Bitcoin went from $20,000 to $4,000 between 2017 and 2018. Those who didn't sell and bought won. They made, in fact, more than anyone else who bought during the uptrend.

review your knowledge

Although bear markets certainly make it more difficult to profit while trading or investing in long positions, they offer an often much-needed respite from the maelstrom of a bull market .

For absolute beginners, bear markets are a good context to hone your understanding of cryptocurrencies and the Blockchain space in general, focusing on the how and why of the major cryptocurrencies and becoming familiar with the factors that influence the market and its volatility .

You should look at things like technical analysis to identify market patterns on which to base your strategy. By making sure that you are correctly informed, you will have better margins of maneuver in the event of unforeseen events.

not everything will collapse

Bear markets can be a daunting time for crypto enthusiasts, who have to watch their portfolios experience heartbreaking losses in what could be a short period of time.

But while it is true that the vast majority of cryptocurrencies will experience dramatic losses during the next bear market, not all will, which is why it is suggested to diversify your investments in them .

There are examples like LOOM Network, Metaverse ETP and Binance Coin (BNB) that, unlike others, have grown when the market was predominantly bearish, and even held that value during the tragic 2018.

Taking the time to predict and identify the behavior of altcoins is well worth it.

discounted gems

While bear markets can be tough times for many investors and traders, they also present the best possible opportunity to buy promising coins and tokens at rock-bottom prices.

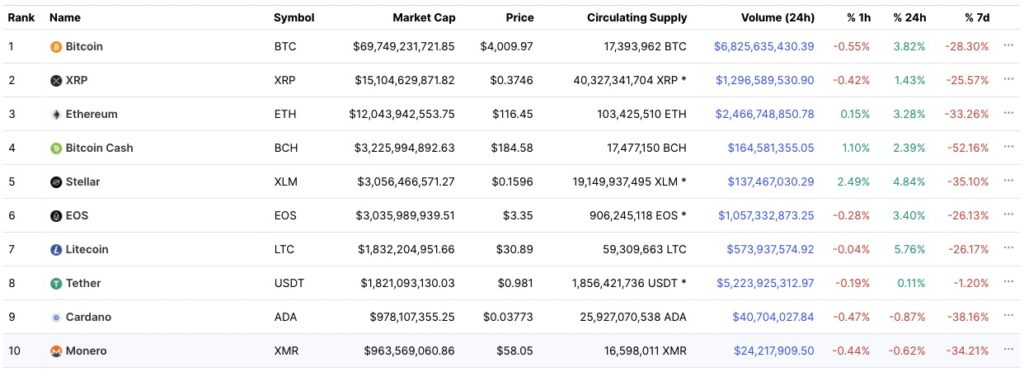

A good example of this is the one represented by the graph found above. We can see, there, how between 2018 and 2020, the vast majority of cryptocurrencies experienced large losses, of up to 90%. Bitcoin, without going any further, suffered a decline of 80% of its value to later grow up to 2000% .

Ironically, few traders bought Bitcoin at or even close to that low point, due to the psychological difficulty of buying an asset after such a sizeable drop . And less in those days.

That's why mental toughness is key to finding those discount gems we mentioned.

Time to work on your network

The last thing you should consider to survive the current bear market is that you can still lean on other things. We mean, with this, that this is surely a good platform to work on your network .

In a fast-paced, innovation-driven industry like cryptocurrencies, your network of contacts will be essential to discover first-hand disruptive projects and apply for future jobs in Blockchain.

The more people you meet who develop in this field, the more varied your possibilities will be. And to the extent that this is the case, the chances of finding that gap in which you feel really comfortable are greater.

To get started, and especially if you're looking for events, CoinMarketCap's calendar could help.