With Kwitt and Giropay, the Sparkasse provides good options for a quick transfer without an IBAN exchange. You just have to be physically close and you can settle smaller bills straight away. Hence the name - KWITT - because then you are "quitt" with your friends.

How does Kwitt work?

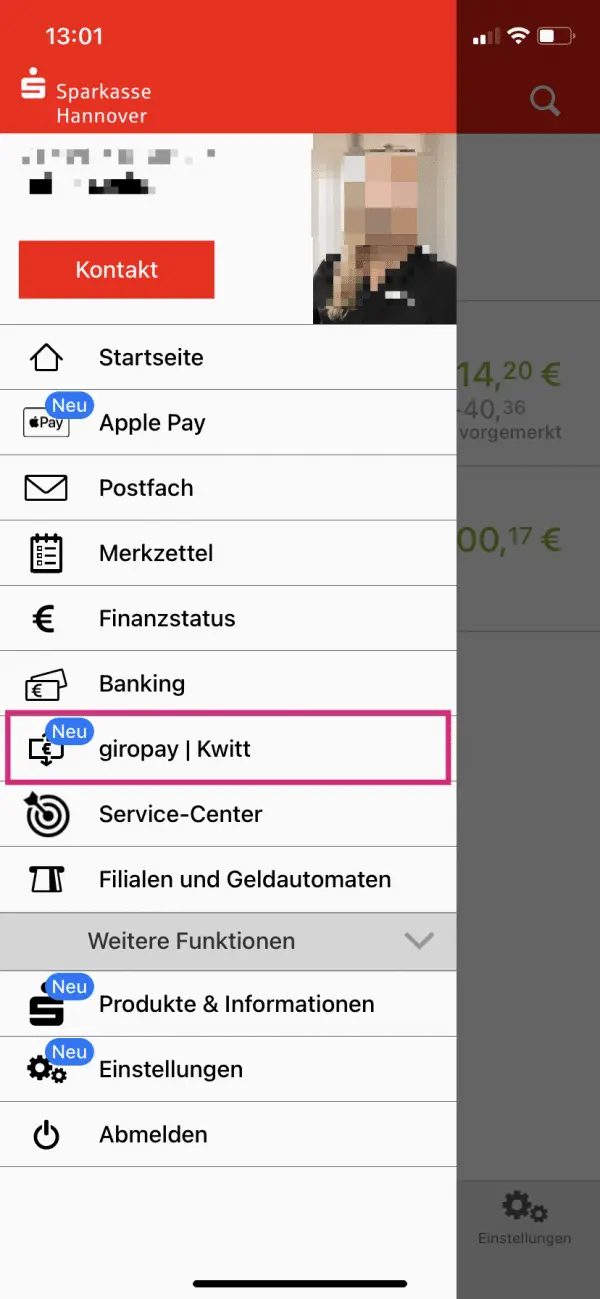

Kwitt is a service of the savings banks and Volksbanks. In addition to its own app, it is also part of the Sparkasse banking app. To do this, simply go to Kwitt in the app menu.

You can find Kwitt in the Sparkassen app menu.

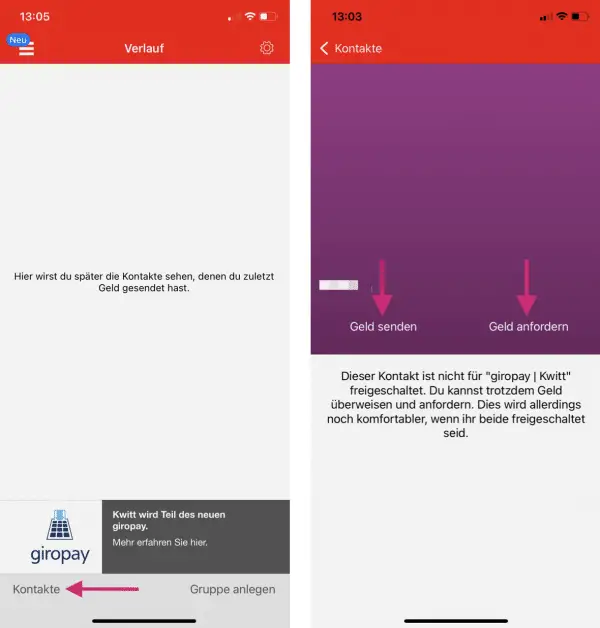

You can find Kwitt in the Sparkassen app menu. Your own identification takes place via the mobile phone number. If you want to send someone money, you only have to enter their mobile phone number (for example from the address book) and do not have to enter the complicated IBAN. If the person is already using Kwitt, the money will go straight to their bank account. If he or she is not registered as a Kwitt user, the person will receive a link to enter the IBAN. Plus, you can even request money. The person in question then receives a push message with your money request. You can also create a group to which you can add the desired contacts. For example, they can get together for a surprise party..

Once you've set up Kwitt, you can send or request money to your cell phone contacts.

Once you've set up Kwitt, you can send or request money to your cell phone contacts. But that's not all: You can send amounts of up to 30 euros without a TAN. So it is almost as if you were simply handing the money to your contact - without any major effort or additional costs. Because Kwitt is a free service from the Sparkassen app. In addition, this process has no age limit - you can always use it if you have a Sparkasse current account.

By the way: Kwitt has now been integrated into the Sparkasse app as normal. It was merged with some other online banking services as the Giropay brand or "giropay Geld-Senden".