Again and again you come across the expression "TAN" in everyday life and also on the Internet. This often happens in connection with online banking or similar security issues. In the following we will discuss what is meant by a TAN, how it is used and what different types of TAN procedures there are.

What is a TAN?

The term "TAN" stands for transaction number and is used in the TAN procedure. This security procedure is based on the fact that you have to enter a numerical code after carrying out an action for confirmation. The TAN procedure is used, for example, in online banking: After you have entered your transfer details, you have to insert a longer sequence of numbers before the actual money transfer, which you can get sent to another device, for example. This is to prevent someone from transferring money without your permission. The way it works is similar to a PIN in physical banking or on a smartphone

What types of TAN procedures are there?

smartTAN procedure

With this procedure, which is also known as the chipTAN procedure, your bank will send you a TAN generator. The costs for such a device are up to € 15, but they are often provided free of charge. The device is used when you want to carry out a transaction in online banking. At the end, a kind of flashing barcode is displayed here, which can be read out by the device. To do this, insert your bank card into the TAN generator and then hold the device in front of the computer screen. After a successful reading process, the number is displayed on the device screen, which you enter in the corresponding field on the computer. Only then can the transfer be carried out.

mTAN procedure

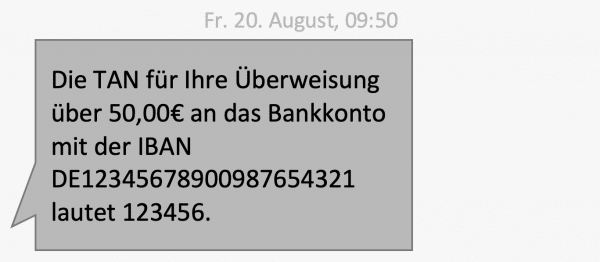

The "m" in mTAN stands for "mobile". A new TAN number is sent directly to your smartphone when you complete a transaction. So when you make a transfer, you will receive a message from your bank. This increases security, because even if your PC is infected with malware, an online banking transfer cannot be made without your consent. However, this method can also have disadvantages, especially if the network coverage is currently not particularly good. Without a mobile phone network, you cannot of course receive any SMS..

Example of an SMS message with the TAN for a transfer.

Example of an SMS message with the TAN for a transfer. To prevent this disadvantage, many banks are now using the pushTAN procedure. You use a banking app from your bank that generates the TAN for you. Alternatively, there is also the photo TAN procedure, which works in a similar way to the smartTAN: an image code is generated on the banking website, which you can read out using a smartphone app. Your smartphone then shows you the corresponding TAN, which you can use to proceed further.

iTAN procedure

This procedure was abolished on September 14, 2019. For the sake of completeness, it is mentioned here anyway.

The iTAN process is now a rather outdated process. A paper TAN list will be sent to you. Each TAN is assigned to a number. If you should now enter a TAN to confirm a transfer, the banking system asks you, for example, "Enter TAN No. 98". As soon as a TAN has been used, you have to delete the number from the list by hand. If numerous TANs have been deleted from the list, you should ask your bank for a new list. A possible security risk with this procedure is that the TAN is not freshly generated, as with the other methods, but is fixed beforehand. So if someone - even if only once - has the chance to copy your list, this person can make unauthorized transactions.So if you receive an iTAN list in the mail and the letter looks damaged, request a new list from your bank..