Klarna is a Swedish provider of financial services. When you shop online, you can use the service to pay for your orders at participating online shops. You can choose between purchase on account, in installments or a transfer. How exactly these payment methods work at Klarna and how you use the service can be found in this article.

This is Klarna

The financial services provider Klarna is based in Stockholm. He offers different payment methods for online purchases: Klarna invoice, Klarna financing (installment purchase) and pay immediately. Payment with Klarna is free of charge for you as a customer. It is now offered in many online shops. You can use the service provider's app to manage your payments and purchases. Here you can, for example, track your deliveries, take advantage of exclusive offers and create a wish list. Since the beginning of 2021 you can also open a current account with Klarna in the app, the test phase is still ongoing.

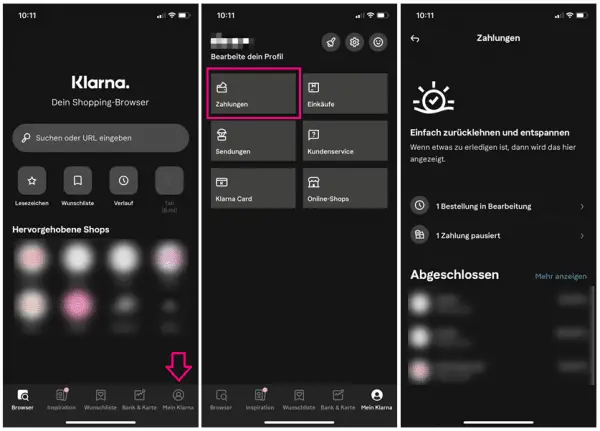

In the Klarna app you can manage all your Klarna payments and have an overview of your purchases and deliveries.

In the Klarna app you can manage all your Klarna payments and have an overview of your purchases and deliveries. This is how Klarna invoice works

If you select Klarna invoice for payment, the following happens: Klarna transfers the amount directly to the retailer, you now have 14 days to transfer the money to Klarna and pay the invoice in this way. So you can wait for the goods to arrive and check them before paying. You can extend the billing period for a fee. If you are not satisfied with the goods, you can "report a problem" in the Klarna app or report a return and thus pause your payment to Klarna.

Installment payments can bring you many advantages, but also some disadvantages. We have listed them for you here:

| advantages | disadvantage |

| Money does not have to be transferred until the goods have been received | Additional fees apply |

| Goods can be checked before paying | Payment term is relatively short |

| No going back and forth on returns | High reminder fees if the payment deadline is exceeded |

| Many online shops now offer payment with Klarna | Personal credit limit is not visible |

| Vorteile | Nachteile |

| Geld muss erst nach Erhalt der Ware überwiesen werden | Es fallen zusätzliche Gebühren an |

| Ware kann vor dem Bezahlen überprüft werden | Zahlungsfrist ist relativ kurz |

| Kein Hin- und Her bei Rücksendungen | Hohe Mahngebühren, falls Zahlungsfrist überschritten wird |

| Viele Online-Shops bieten inzwischen Bezahlung mit Klarna an | Persönliches Kreditlimit ist nicht einsehbar |

Installment payment via Klarna

Even if you choose to pay in installments when shopping online, Klarna will first pay for you. You can then make your payment to Klarna in installments - stretched over a period of up to 24 months. The installments can be fixed or flexible, and you can always decide to pay the full balance at once..

The "Pay now" function

The "Pay now" function includes instant transfer, payment by credit card and payment by direct debit. To use instant transfer or direct debit, your current account must be activated for online banking. You then select your country and bank at Klarna and then log in with your access data for online banking. Klarna forwards these to your bank in encrypted form.

You then carry out the transaction directly via your online banking as you are used to. Depending on the chosen payment method, the money will then be transferred immediately or debited from your account a few days later. The "Sofort" service, which has been part of Klarna since 2014, is used for instant transfers. Payment by credit card works as usual,by providing your card details.

What are the fees for Klarna?

Even if paying on account often seems free of charge, appearances are deceptive. Klarna also has fees that the retailer can pass on to you as a customer. As a rule, when purchasing on account, this is around € 1.00 to € 1.50 per purchase. If you choose to pay in installments, the costs will be higher. Additional fees and interest come into play. However, the exact costs depend on the provider. But be careful: If you fail to meet the payment deadlines for all methods, very high dunning fees can quickly arise. As a rule, these amount to 1/24 of the purchase price, but never less than € 6.95.

If you work as a dealer yourself, you can calculate exactly how high the costs will be. When paying on account, it is 3.25% of the purchase and an additional € 1.69 per transaction. With an immediate transfer, only 1.35% of the purchase value and an additional € 0.20 per transaction are charged. A flat rate of 3.00% applies to installment payments without any additional fees..

Klarna system solution for online retailers

Online retailers can integrate the presented payment solutions individually into their shop. Klarna also offers a complete system solution for companies, the Klarna Checkout. Klarna takes over the entire payment processing in the online shop and offers all of the payment options mentioned.